2024 is poised to be a year of significant change throughout all of healthcare, but especially in post-acute and rehabilitation. This guide breaks down 7 trends expected to impact inpatient rehabilitation in 2024 and how acute hospitals can position themselves to capitalize on these trends and deliver exceptional patient care. |

TOP REHABILITATION TRENDS FOR 2024:

1. Heightened Focus on Financial Performance

1. Heightened Focus on Financial Performance

Eighty percent of health leaders are prioritizing financial performance in 2024, notes a Healthcare Financial Management Association (HFMA) survey.1 Specifically, health leaders report a financial focus on developing inpatient rehabilitation facilities (IRFs) to aid in improved patient outcomes and overall performance.2

Two financial trends making growth areas, like inpatient rehabilitation, especially important are:

-

- MEDICAL SPENDING: In the coming years, the average growth in National Health Expenditure is projected to outpace the average Gross Domestic Product growth.3 If the current trajectory continues, health spending will triple to nearly $12 trillion by 2040.2

This rapid rise is heavily linked to increasing medical costs. PwC’s Health Research Institute projects 2024 medical costs to exceed both 2022 and 2023 trends.4

- MEDICAL SPENDING: In the coming years, the average growth in National Health Expenditure is projected to outpace the average Gross Domestic Product growth.3 If the current trajectory continues, health spending will triple to nearly $12 trillion by 2040.2

-

- COST MANAGEMENT: To maintain financial performance – while staying on track with medical spend rates – hospitals are looking for ways to manage their existing costs.

The investment in value-based care (VBC) has played a significant role in improving hospital savings and patient outcomes – especially in the rehabilitation setting. The more hospitals that integrate VBC as a cost management strategy, the more medical cost trends will see a decline.2

- COST MANAGEMENT: To maintain financial performance – while staying on track with medical spend rates – hospitals are looking for ways to manage their existing costs.

To help overcome these challenges and seize the opportunity in rehabilitation, many health systems are looking to joint venture or contract management partnership with a specialized expert.

2. Ongoing Staffing Strains

2. Ongoing Staffing Strains

Although healthcare employment began to recover in 2022, a noticeable gap remains for the rehabilitation nursing workforce and could lead to significant impacts across post-acute settings.

More than 50% of healthcare workers attributed an unmanageable workload to a lack of resources – a key contributor to burnout and turnover, according to a PwC Workforce survey.5

Hospitals don’t expect a short-term resolution for the clinical staff shortage, but those hospitals that seek support outside their organization – specifically through a strategic partnership – could see improvements to the locating, hiring, retaining and overall well-being of their rehabilitation staff.

In addition to retaining necessary staff, the right partner will aid in driving up utilization to take on rising medically complex patient demand. This is made possible through a partner’s ability to provide specialized rehabilitation education and training to help staff supply the highest quality of care to the right patient at the right time in their care journey.

3. Increased Interest in Digital Health Innovation

3. Increased Interest in Digital Health Innovation

Hospital financial and operational challenges have only increased the interest for digital healthcare solutions. A key area of investment for rehabilitation programs in 2024:6

-

- ARTIFICIAL INTELLIGENCE (AI): AI helps rehabilitation staff take a more comprehensive approach to care, improve care coordination and help patients better manage and comply with treatment programs.

Additionally, AI and robotics have increasingly been used in inpatient rehabilitation to improve patient engagement and outcomes, and help reduce overall care cost. As these various AI solutions become more sophisticated and affordable, the healthcare industry can expect to see even more widespread adoption of these technologies.

- ARTIFICIAL INTELLIGENCE (AI): AI helps rehabilitation staff take a more comprehensive approach to care, improve care coordination and help patients better manage and comply with treatment programs.

One way hospitals are gaining access to innovative AI solutions is through joint venture or merger and acquisitions (M&A) partnership opportunities.7

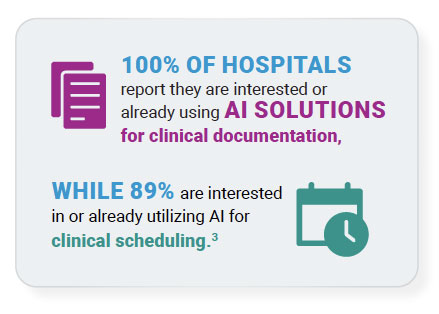

In a survey conducted by the Advisory Board, 100% of hospitals report they are interested or already using AI solutions for clinical documentation, while 89% are interested in or already utilizing AI for clinical scheduling.3 This growing interest makes finding the right partner all the more important.

4. Shifting Healthcare Consumerism Needs

4. Shifting Healthcare Consumerism Needs

In a McKinsey & Company report, 90% of health executives and 100% of CMOs identified healthcare consumerism as a top priority for their companies.8

As more patients choose to take control of their health and wellness, particularly how, when and where they receive care, it is important for hospitals to understand the current healthcare consumer market trends and how those trends will impact the way their rehabilitation programs operate.

-

- BEHAVIORAL HEALTH: Patients with behavioral health conditions – in addition to physical conditions – drive roughly 57% of all healthcare spending. This is due largely to the growing number of admissions/readmissions to the emergency department (ED) for behavioral health services.

The number of patients receiving care for their behavioral health conditions is only expected to grow in the coming years. If adequate behavioral health resources are placed within the hospital setting – and alongside a comprehensive rehabilitation program – admissions to the ED will decline and could lead to over $4 billion in annual ED cost savings.9 - SELF-MANAGEMENT: An increasing number of patients want to be involved in their health journey, whether it be pre- or post-treatment, or everything in between. Patient self-management is critical, especially for those with medically complex conditions.

A key factor to self‑management is a patient’s activation level, which refers to an individual’s ability and probability to practice self-care.5 For inpatient rehabilitation, this is especially critical during care and following discharge to avoid readmission and added care cost.

Hospitals that prioritize patient engagement during and after their treatment will contribute to positive patient self-management – improving overall outcomes for the patient and hospital.

- BEHAVIORAL HEALTH: Patients with behavioral health conditions – in addition to physical conditions – drive roughly 57% of all healthcare spending. This is due largely to the growing number of admissions/readmissions to the emergency department (ED) for behavioral health services.

Addressing healthcare consumer needs while maintaining strong hospital performance can be challenging. Having a partner with a pulse on the latest rehabilitation and patient trends has proven to be an exceptional strategy for hospitals – especially within the regulatory environment.

5. Impending Regulatory Priorities

5. Impending Regulatory Priorities

Regulatory changes brought on by CMS have tested the abilities of rehabilitation hospitals across the country. Two regulatory changes of note for 2024 and beyond include:

-

- REVIEW CHOICE DEMONSTRATION (RCD): RCD is expected to have major impacts on hospital operations – specifically denials management.10 The first RCD went into effect in Alabama in August 2023, with the goal of protecting Medicare funds from mis-payment and fraud, and will go into effect in additional states in the coming years.

Although hospitals receive timely notice of their state’s implementation, modifications throughout the process are to be expected – making preparation and education critical. - IRF PROSPECTIVE PAYMENT SYSTEM (PPS) FINAL RULE: CMS increased payment rates by $355 million for 2024 – a result of several factors, including inflation and changes in the IRF market basket. 11

Additionally, CMS set new modifications for excluded units. This allows hospitals to open a new rehab unit and begin being paid under the IRF PPS at any time during the cost reporting period. Historically, hospitals could only open a new unit at the start of a cost reporting period.11

- REVIEW CHOICE DEMONSTRATION (RCD): RCD is expected to have major impacts on hospital operations – specifically denials management.10 The first RCD went into effect in Alabama in August 2023, with the goal of protecting Medicare funds from mis-payment and fraud, and will go into effect in additional states in the coming years.

Whether it be a state-specific change or nationwide implementation, having support from a partner with access to local and national resources is important for hospitals to adequately prepare for these changes.

6. Continued SNF Challenges

6. Continued SNF Challenges

CMS announced a 3-hour daily nurse staff requirement for skilled nursing facilities (SNFs) in 2023.12 Several studies forecast SNFs will not be able to comply with the new rule, as it is expected to cost the industry over $10 billion to maintain.13

“This can have real ripple effects throughout the continuum of care,” stated Akin Demehin, American Hospital Association senior director of quality and safety policy. “The longer that a patient has to wait for a placement in a SNF… the longer they’ll be in the hospital, and that can create some spillover effects for the rest of the hospital.”14

Challenges hospitals could face following the new SNF requirement:15

-

- Patient throughput obstacles due to limited SNF beds – resulting in longer inpatient stays without appropriate discharge options.

- Increased financial pressure on other post-acute settings resulting from rising admission volumes due to SNF accessibility.

- Staffing minimums for other care settings once the SNF mandate is enforced.

- Patient throughput obstacles due to limited SNF beds – resulting in longer inpatient stays without appropriate discharge options.

Hospitals that are not prepared for the SNF mandate could face challenges that hinder the delivery of effective care to the right patients. Partnership has never been more important for hospital stability.

7. Expanding Partnership Activity

7. Expanding Partnership Activity

Approximately 45% of acute care discharges nationwide are admitted to a post-acute setting. One setting that continues to see substantial growth across the care continuum is inpatient rehabilitation.15

As hospitals continue to get inundated with patient admissions, having an inpatient rehabilitation program in place with the guidance and support of a qualified partner has never been more important.

In fact, hospitals are increasingly looking to partner via joint venture, contract management or M&A with a qualified rehabilitation expert to achieve improved outcomes, patient engagement and financial performance.16

Similarly, co-locating – or the integration of specific service lines under the same hospital roof or campus – continues to see growth, especially for inpatient rehabilitation and behavioral health programs.3,4

Preparation Is Key: Why Partnership Is a Critical Next Step

To reap the full benefits of partnership, it is critical to find a partner that meets your hospital’s unique needs, mission and vision. Not all joint venture or acute rehab management partners are created equal.

Hear from our partner hospitals on how Lifepoint Rehabilitation’s decades of expertise and national footprint have enabled them to keep up with shifting care needs, while also improving outcomes and delivering greater patient access.

Visit LifepointRehabilitation.net to learn how Lifepoint can help your hospital stay ahead of shifting trends while maintaining strong performance and outcomes.

References

- HFMA, (August 2023), Service line trends survey Summary Report, [PowerPoint Slides], Healthcare Financial Management Association

- Seegobin, Vidal. (September 2023). 2023 Strategic planner survey results, [PowerPoint Slides]. Advisory Board

- https://www.cms.gov/research-statistics-dataand- systems/statistics-trends-and-reports/ nationalhealthexpenddata/nhe-fact-sheet

- https://www.pwc.com/us/en/industries/healthindustries/ library/assets/pwc-behind-thenumbers- 2024.pdf

- https://www.pwc.com/gx/en/issues/c-suite-insights/ the-leadership-agenda/healthcare-workers-lackcapacity- in-key-areas.html

- https://www.pwc.com/gx/en/industries/healthcare/ publications/ai-robotics-new-health/transforminghealthcare. html

- https://www.pwc.com/gx/en/services/deals/trends/ health-industries.html

- https://www.mckinsey.com/industries/healthcare/ our-insights/driving-growth-through-consumercentricity- in-healthcare

- https://www.milliman.com/-/media/milliman/pdfs/ articles/milliman-high-cost-patient-study-2020.ashx

- https://www.cms.gov/es/node/1691166

- https://www.cms.gov/newsroom/fact-sheets/fiscalyear- 2024-inpatient-rehabilitation-facility-prospectivepayment- system-final-rule-cms-1781-f

- https://skillednursingnews.com/2023/09/cms-toissue- nursing-home-staffing-mandate-of-3-hours-perresident- per-day/

- https://www.ahcancal.org/News-and- Communications/Fact-Sheets/FactSheets/CLAStaffing- Mandate-Analysis-Dec2022.pdf

- https://www.beckershospitalreview.com/workforce/ what-nursing-home-staffing-ratios-could-mean-forhospitals. html

- https://www.advisory.com/topics/post-acutecare/ 2023/04/snf-staffing-mandate

- https://go.beckershospitalreview.com/financewp/10- must-read-articles-for-c-suite-leaders-on-currentfinancial- headwinds-and-growth-strategies